Why Choose Zoho Books?

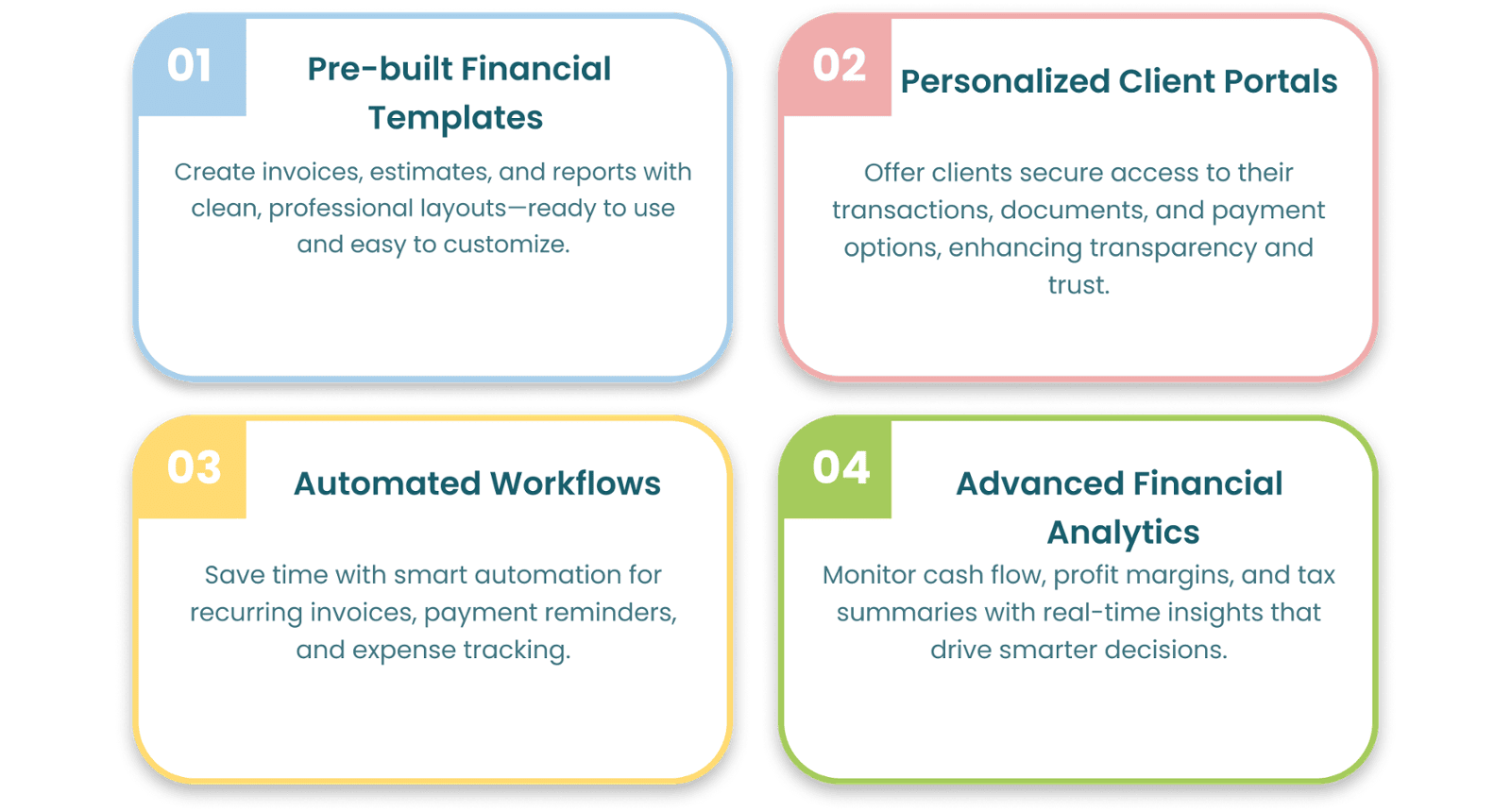

Zoho Books simplifies accounting by offering smart automation, intuitive design, and powerful financial tools—all in one place. From creating invoices and tracking expenses to filing taxes and analyzing cash flow, it helps businesses stay organized and compliant. With personalized client portals, automated workflows, and seamless integrations, Zoho Books is built to scale with your growth while keeping your finances crystal clear.

Books Pricing

Standard

₹749

Price/Org/Month Billed Annually

Professional

₹1,499

/user/month billed annually

Premium

₹2,999

/user/month billed annually

Elite

₹4,999

/user/month billed annually

Frequently Asked Questions

Search for a questions